Saving a Million Dollars

Saving a million dollars is not impossible.

It takes hard work, smart business and investing choices.

It seems like Financial Advisors hear a lot of the same things around the world.

“I don’t know how much money to save each month.”

“I keep blowing my money on useless things like food processors.”

“I pay too much in taxes to save any money.”

“I don’t have anything to save for.”

“Will I have enough to retire on?”

Do these quotes sound familiar? These are some things I hear every week, and it shouldn’t be this tough.

Today, we’re going to use a case study to show how simply putting away some money each month can create a world of difference in the years to come.

Saving a Million Dollars in 2017 FAQ’s

Why is it so important to have your own savings if the Age Pension exists?

- The Age Pension amounts and the eligibility to receive it seem to change every election campaign.

- The Age Pension is meant as a safety net for those whom can’t support themselves in retirement;

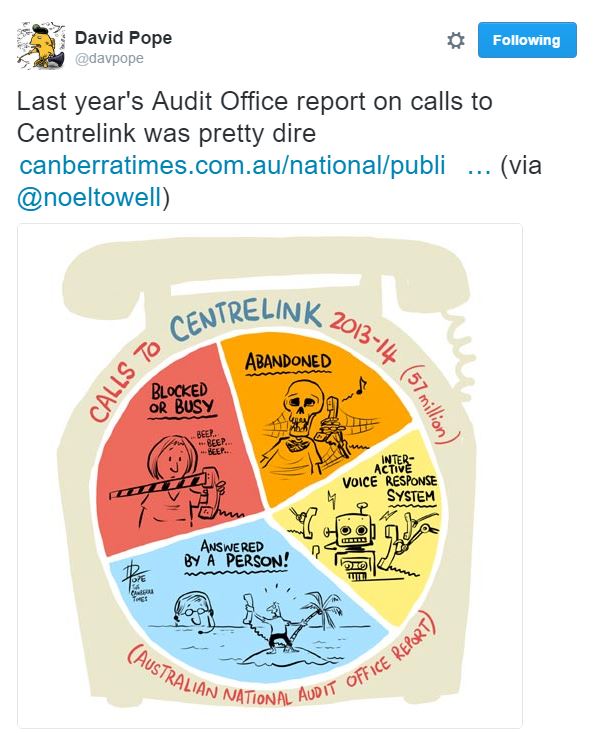

- Have you ever tried using Centrelink in the past? The Audit Office gave a fairly scary report recently.

So, how much do you need to save as a benchmark?

There is no magic answer.

So, let’s use Mark Bouris’ famous quote about needing $1 million to retire comfortably.

Everyone’s idea of comfortable is different, so your own situation may need a higher or a lower figure.

For now, let’s stick with the $1 million.

Saving a Million Dollars Start with a Plan

Money Saving Goals –

Create a goal of how much you need to retire on. Make it achievable and realistic. In this case, we’re using $1 million.

Regularity –

As soon as your salary gets deposited each month or pay cycle, a portion of it goes to another bank account, ideally with no ATM access, and held with another bank. If it’s harder to access, you won’t be as tempted to use it immediately.

How much? –

I talk a lot around the concept of 70/20/10. That is:

- 70% goes to daily spending and essentials;

- 20% goes to short term savings for fun/holidays/property deposits; And

- 10% goes to longer term savings and investments.

The more you can save each month, the better, but 10% to your longer term goals is a great place to start.

Earnings or Rates –

Difficult as at this moment in time, given the low deposit rates that we have in Australia currently, however over the longer term, use 6% as a benchmark. This represents a mix between a very low deposit rate and the longer term growth that historically we’ve seen from investment markets over the past 100 years.

Savings Accounts or Investments –

When you’re getting started, simply holding any excess cash in a savings account that earns interest is a great start. As you progress, you may wish to invest your savings either through superannuation or through another type of investment structure.

Attitude to risk –

Generally, there is a correlation between returns and risk. As you increase your attitude towards risk, your chance to have greater returns increases over the long term. This is different for everyone, and you should consider your own attitudes towards fluctuations in your returns over time.

Start now –

The sooner, the better. We are working with the miracle of compound interest here, so the earlier you start, the better opportunity you will have in future. It’s never too late however, so make a start as quickly as possible.

Emergency Fund –

One thing I mention is to always hold at least 2-3 months’ salary as an emergency fund for easy access. It can be held in a savings account, but holding some money for the unexpected will help you to not cash out your savings at the first sign of trouble.

Photo courtesy of davejdoe(CC Attribution)

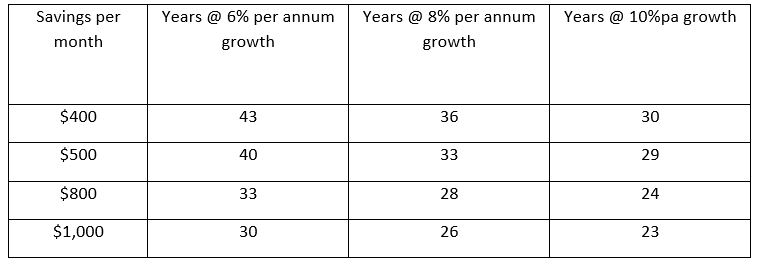

How long will it take to Save A Million Dollars?

As a baseline, let’s use $5,000 as a starting balance. How many years will it take to reach a million dollars?

Again, the earlier you start and the more that you can dedicate per month, the faster the growth. As you receive higher paying roles over time, you can grow your monthly savings and reduce the years required. Not even discussed in the above is that your superannuation will grow as your employer pays in, so this is a bonus $1 million on top of your superannuation savings.

If you’re able to pay off your mortgage, think about using those mortgage repayments to save or invest rather than spending, and you’ll again compound your growth.

If you begin saving regularly, it becomes a habit. By saving a little each month, you can greatly affect your lifestyle in the years ahead, and hold a financial future that you look forward to!

You too can be a millionaire. It just needs a little planning. Then decide what you want to spend it on!

Disclaimer: The information provided on this website has been provided as general advice only. We have not considered your financial circumstances, needs or objectives and you should seek the assistance of your Synchron Adviser before you make any decision regarding any products mentioned in this communication. Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Mirador Wealth Management, Synchron, nor its related entities, employees or agents shall be liable on any ground whatsoever with respect to decisions or actions taken as a result of you acting upon such information. Authorised Representatives of Synchron AFS Licence No. 243313